Graham Beck

Graham Beck is the Co-founder and CEO of DropDesk, a platform dedicated to a singular, transformative mission: unlocking the potential of underutilized spaces to foster human connection.

Graham Beck is the Co-founder and CEO of DropDesk, a platform dedicated to a singular, transformative mission: unlocking the potential of underutilized spaces to foster human connection.

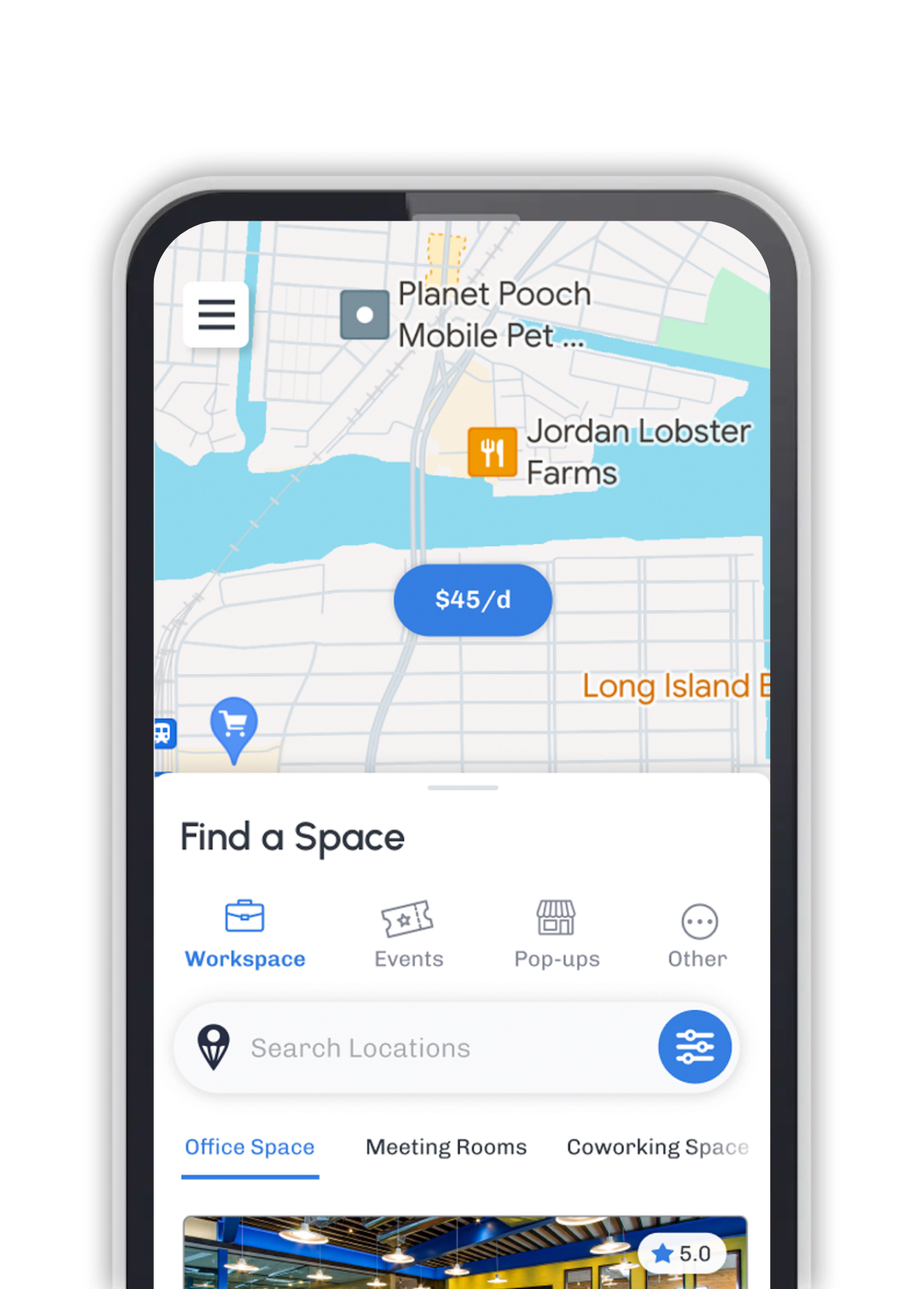

Whether you need a space, want to earn from yours, or are ready to build your own marketplace — we have you covered.

Discover unique local venues for work, meetings, events, and celebrations.

Explore Spaces

Book your favorite spots on the go. Available on iOS and Android.

Are you looking for the most up-to-date data on the state of coworking spaces?

The industry has evolved rapidly from a niche option for freelancers to a primary strategy for enterprise companies. Not sure what is coworking? To save you time, we have curated a comprehensive list of the best coworking statistics for 2026, broken down into actionable categories.

The sector has stabilized and matured. Here is how big the market is today.

The defining trend of 2026 is the "Third Workplace"—not home, not HQ, but a local flex space.

The stereotype of the "hoodie-wearing tech bro" is gone. The demographic is diversifying.

How space operators are making money in 2026. Want to become a host?

What does the modern office look like?

Big business is now the biggest customer.

One size does not fit all. The rise of industry-specific spaces.

The financial argument for flexibility.

Work is no longer a place you go, but something you do—anywhere.

Why people choose shared workspaces.

It's not all perfect. Here are the hurdles the industry faces.

The future is green and connected.