Book, Host, and Build. All on One Platform.

Find Space

Explore and book unique spaces for everyday work, play, meetings, events, and more.

Become a Host

Maximize revenue and reach new customers by becoming a Host on DropDesk.

Create a Marketplace

Launch a booking marketplace for any industry (spaces, rentals, services) with zero code.

How DropDesk Works

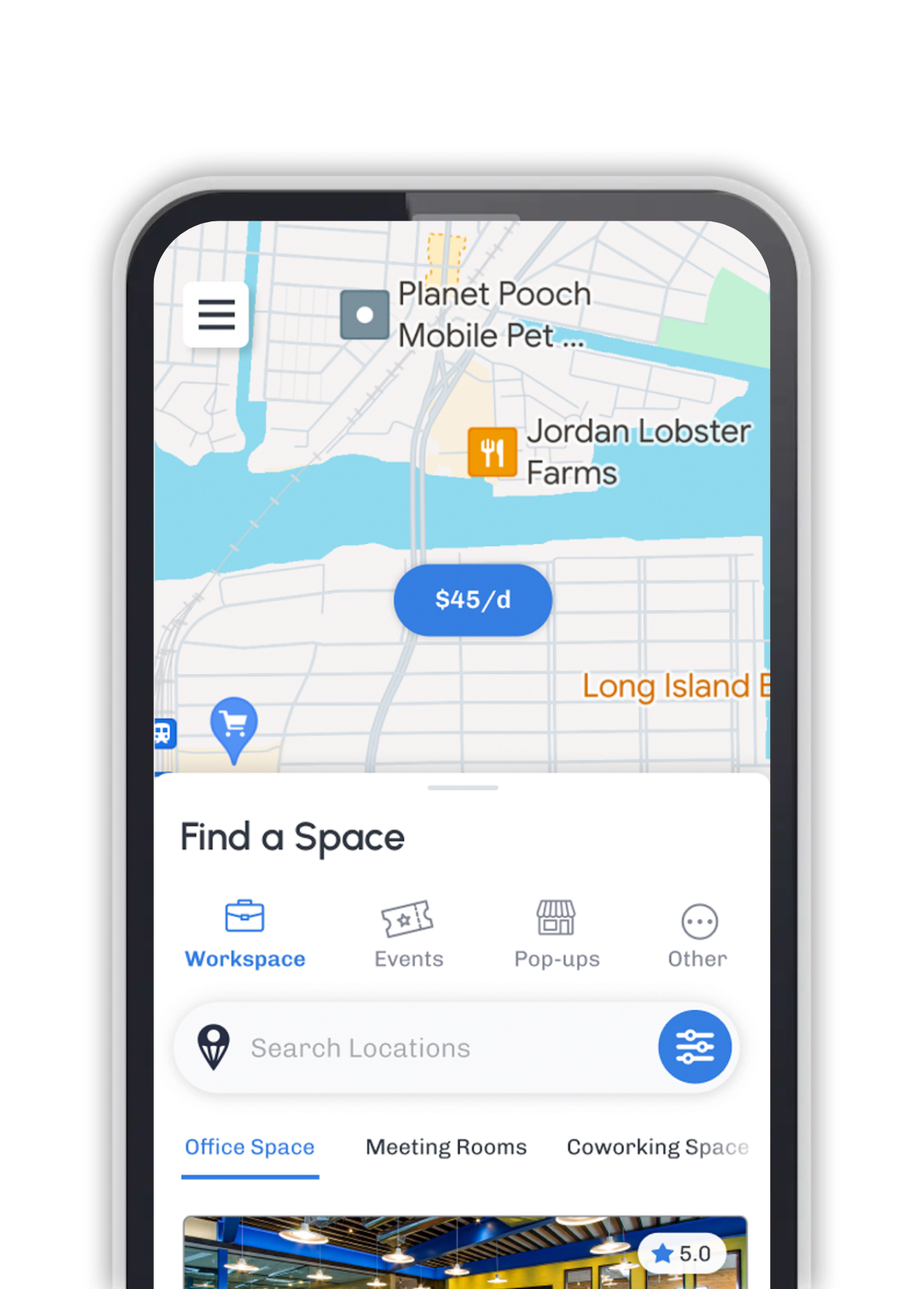

Discover Spaces

Browse thousands of unique spaces, activities, and services. Filter by location, amenities, and price to find your perfect match.

Book Instantly

Book in seconds with our easy booking process. Choose your date, time, and add-ons with just a few taps.

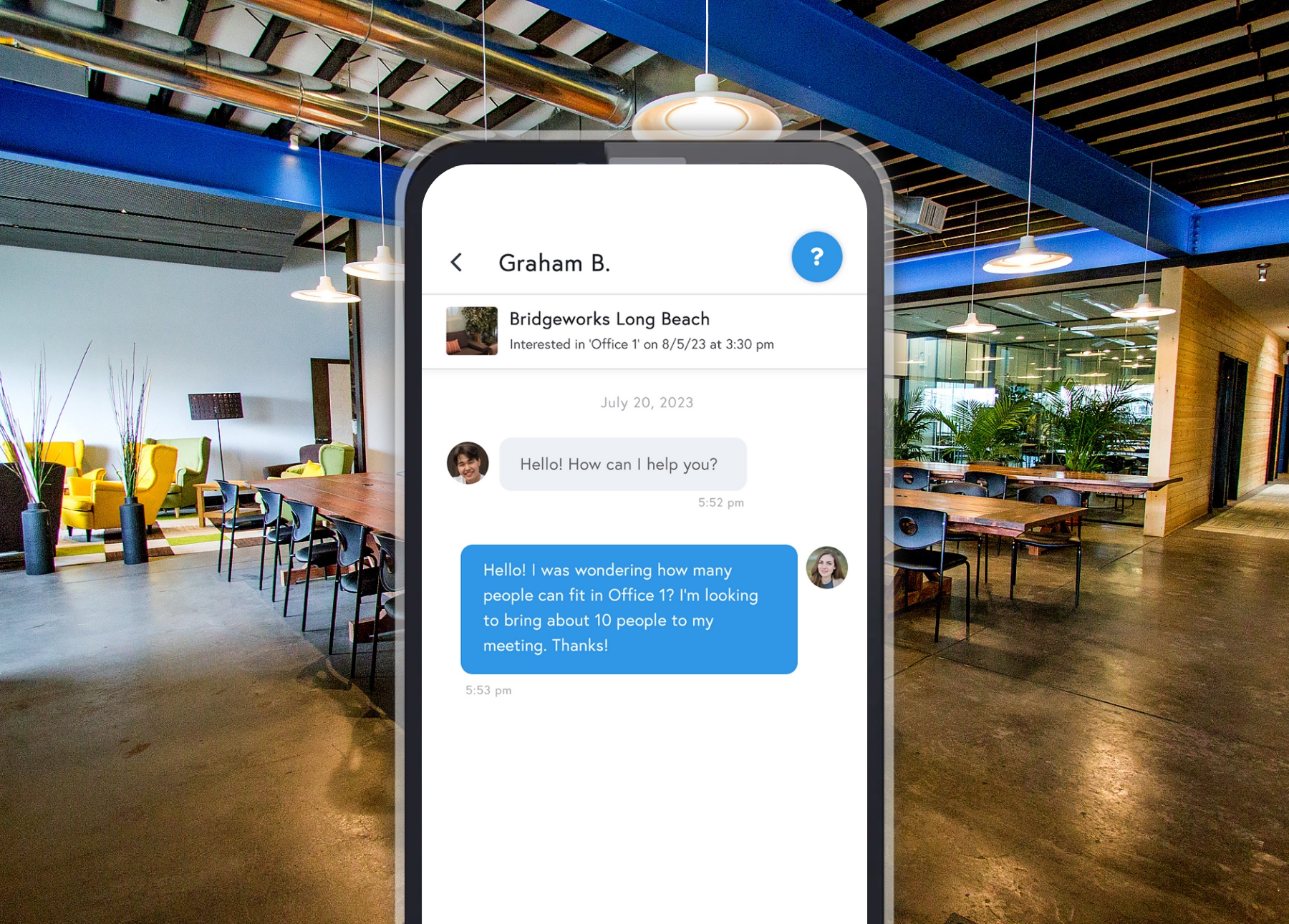

Communicate

Have questions? Message Hosts. Access detailed directions, guest instructions, and everyting you need for a great experience.

Experience & Rebook

Discover everything your space has to offer. Enjoy the unique amenities included with your booking and easily rebook.

Wedding Venue - Brooklyn, NY

Become a Host

Monetize every part of your venue. List your unique spaces, professional services, and bookable activities on DropDesk. Get discovered by local users in your area looking for new ways to work, meet, and create.

Start Hosting

Download the App

Book your favorite spots on the go. Available on iOS and Android.

Frequently asked questions

Everything you need to know about DropDesk