Graham Beck

Graham Beck is the Co-founder and CEO of DropDesk, a platform dedicated to a singular, transformative mission: unlocking the potential of underutilized spaces to foster human connection.

Graham Beck is the Co-founder and CEO of DropDesk, a platform dedicated to a singular, transformative mission: unlocking the potential of underutilized spaces to foster human connection.

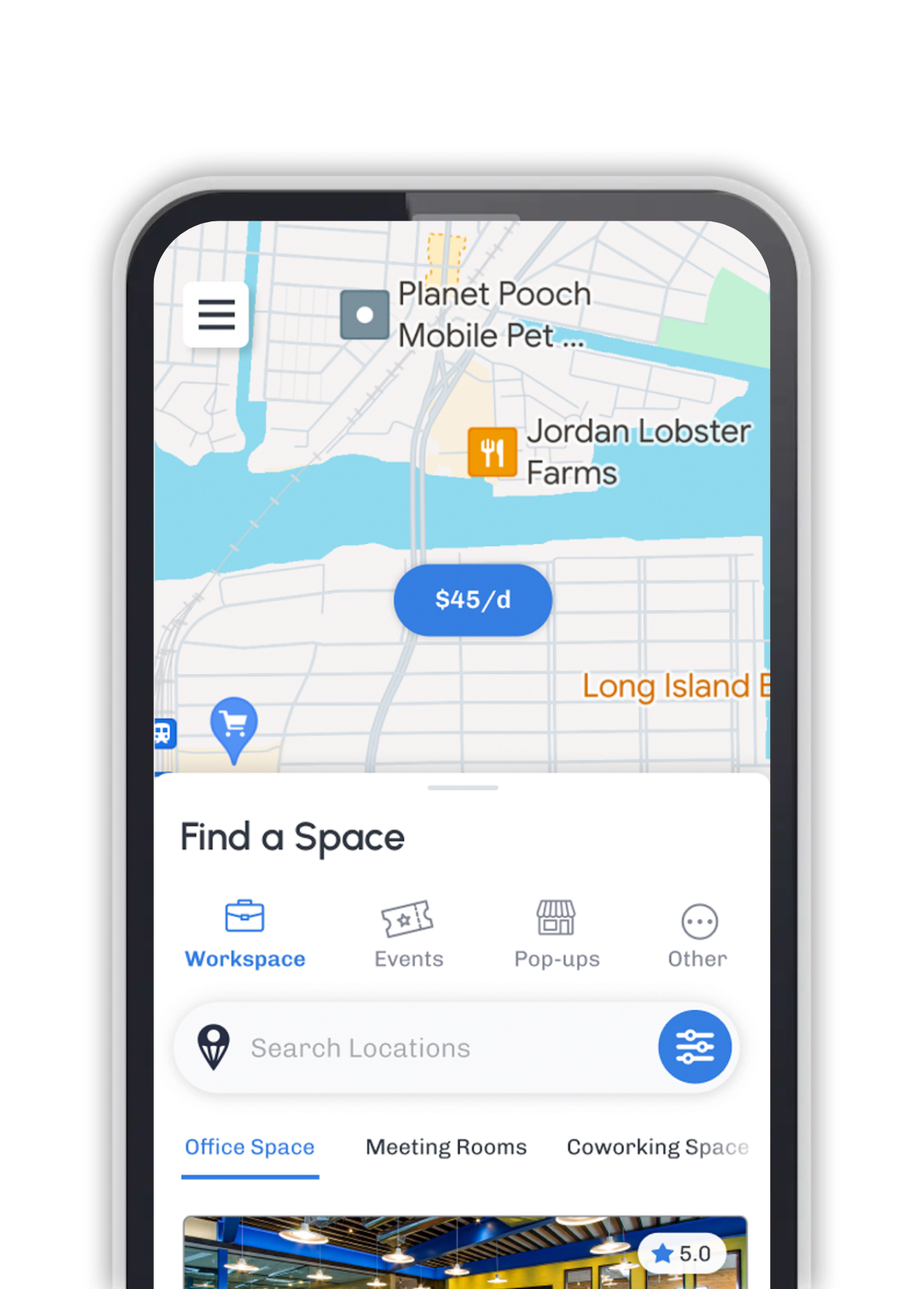

Whether you need a space, want to earn from yours, or are ready to build your own marketplace — we have you covered.

Discover unique local venues for work, meetings, events, and celebrations.

Explore Spaces

Book your favorite spots on the go. Available on iOS and Android.

Whether you are looking to raise money or explain your company's value proposition, you need to come up with a pitch deck. A pitch deck is typically a 10-20 slide presentation that covers the problem you are solving, the opportunity, your target market, how your solution will change lives, and much more.

In this article, we are going to show some of the best pitch decks used to raise capital, along with the context of why they worked.

The Context: Buffer is a social media scheduling tool that allows you to schedule posts for Twitter, Facebook, and LinkedIn. The Round: $500,000 Seed Round (2011) Why It Worked: This deck is widely considered the "gold standard" for early-stage startups because of its simplicity. The founders didn't rely on flashy design; instead, they focused entirely on traction. The deck highlights that they had already launched a minimum viable product (MVP), had paying users, and were growing 15% month-over-month. It proved that the market existed before asking for money.

The Context: Started as a blog and consultancy by Rand Fishkin, SEOMoz pivoted into a software-as-a-service (SaaS) company providing SEO tools. The Round: $18 Million Series B (2012) Why It Worked: Unlike a seed deck that sells a dream, this Series B deck sells hard data. At this stage, SEOMoz was already profitable with millions in revenue. The deck is incredibly detailed (over 30 slides), transparently showing their revenue growth, churn rates, and lifetime customer value (LTV). It effectively argues that with more capital, they could dominate the entire marketing software industry.

The Context: Originally called "AirBed&Breakfast," this platform allows people to rent out their homes or spare rooms to travelers. The Round: $600,000 Seed Round (2009) Why It Worked: This is perhaps the most famous pitch deck in Silicon Valley history. It is a masterclass in brevity—only 14 slides long. The genius lies in the "Problem/Solution" slides. They identified a simple problem (hotels are expensive and disconnect you from local culture) and offered a simple solution (rent from locals). The clear "Market Size" slide also convinced investors that this wasn't just a niche couch-surfing idea, but a billion-dollar opportunity.

The Context: Foursquare is a location technology platform that originally launched as a consumer app for "checking in" to locations to earn badges and become the "mayor" of local spots. The Round: $1.35 Million Series A (2009) Why It Worked: Foursquare introduced the concept of "gamification" applied to the real world. The deck does an excellent job of explaining a brand new user behavior (checking in) by using screenshots of the actual app. It focuses heavily on "The Play"—how the app works mechanically—which was critical because nothing like it existed at the time.

The Context: BuzzFeed is a digital media company known for viral content, quizzes, and news. The Round: Series A (2008) Why It Worked: At the time, news was dominated by traditional, serious outlets. BuzzFeed's deck pitched a radical new idea: "News for the social web." The presentation leans heavily on the visual aspect of their platform and their proprietary algorithm used to predict viral content. It convinced investors that the future of media wasn't just about writing articles, but about technology that understands how people share information.

The Context: Intercom is a customer messaging platform that helps businesses talk to their customers inside their app or website. The Round: $600,000 Seed Round (2012) Why It Worked: This deck is unique because it spends very little time on "the solution" and a lot of time on "the problem." They argued that current tools (like help desks and email marketing) were impersonal and spamy. By clearly articulating how broken the current state of customer communication was, the investors were practically begging for the solution by the time it appeared on the slides.

The Context: The world's largest professional network. The Round: $10 Million Series B (2004) Why It Worked: This is a pitch to Greylock Partners by Reid Hoffman. At the time, LinkedIn had users but zero revenue. The deck is famous for addressing the "Chicken and Egg" problem of building a network. Hoffman successfully argued that "Network 1.0" was about directories, but "Network 2.0" (LinkedIn) was about trusted connections. He sold the vision of LinkedIn becoming the "professional profile of record" for every human on earth.

The Context: Mixpanel is an advanced analytics platform for mobile and web. The Round: $65 Million Series B (2014) Why It Worked: While most analytics tools focused on "page views," Mixpanel focused on "actions" (e.g., did the user click the button?). This deck was used to raise a massive round from Andreessen Horowitz. It works because it focuses on "Capital Efficiency." One of the key slides shows their "Sales Payback Period" is less than 6 months—meaning for every dollar they spend on sales, they make it back (and more) very quickly. This signaled to investors that pouring money into the company would yield predictable returns.

The Context: Front is a shared inbox for teams (e.g., managing a support@ or sales@ email address together). The Round: $10 Million Series A (2016) Why It Worked: Front's deck is praised for its clean design and extreme transparency. They publicly shared their revenue numbers, churn rate, and even their "Net Promoter Score" (NPS). The deck effectively argues that email is the most used tool in business, yet it hasn't been updated for teams in decades. By showing steady, consistent growth graphs, they proved they were the ones to fix it.